By Josh Lew

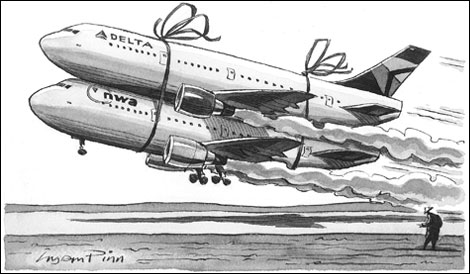

Many people thought that the era of mergers and acquisitions ended when American Airlines joined forces with U.S. Airways. That mindset has just been proven false with Alaska Airline’s acquisition of Virgin America.

Instead of asking “are we done yet?” many are wondering which airlines will be the next to consolidate.

No more legacy carrier mergers

The three remaining legacy carriers are too big to merge with each other. Regulators would probably never approve a merger between, say, United and Delta. There are simply too many antitrust issues.

Southwest is probably also large enough to fit in this too-big-to-merge category. Though it might make more sense for it to merge with a legacy carrier (and become its low-cost wing) than for two legacies to merge with each other, approval for a Southwest merger would be very difficult, if not impossible, because of the low-cost carrier’s size.

Smaller airlines could be the next to merge

That leaves airlines that are further down the size rankings. With its recent Virgin America purchase, Alaska Airlines is now the fifth largest carrier in the country. Though Virgin was a relatively small airline, Alaska probably won’t be making any other acquisitions in the near future. It will take time for it to absorb Virgin’s debt and combine operations.

Frontier Spirit

Some in the industry have expected a merger between Frontier and Spirit, two of the most successful ultra-budget airlines in the country. Such a partnership has been the subject of speculation since well before the Alaska-Virgin deal. Both these airlines have a similar business model and similar services, so they would be able to meld their operations quite easily.

Rumors of a Frontier-Spirit marriage have gained new energy now that a former Spirit exec is at the head of Frontier and Spirit’s new CEO was running AirTran when it merged with Southwest in 2010. However, this deal would likely not go forward until Frontier goes public, something that is in the works but has not yet taken place.

Blue Hawaiian

JetBlue was looking for a merger as well. It has emerged that the airline, which is now the sixth largest in the United States, was trying to acquire Virgin America. ‘Blue was outbid by Alaska, but the move did show that the carrier is open to the possibility of merging its operation with another airline.

But one has to wonder if there are any logical merger targets left for JetBlue now that VA is off the market. A Southwest merger isn’t in the cards, and ultra-budget airlines don’t seem like a good match for JetBlue’s cool image and state-of-the-art in-flight experience.

There haven’t really been any recent rumors about a deal between Hawaiian Airlines and JetBlue, but it does seem like a match that could work. Hawaiian serves its namesake state from the West Coast, and JetBlue has a number of routes in the Eastern U.S. A merger could give Hawaiian a nationwide network to feed its bread-and-butter flights to the islands from the West Coast. JetBlue, meanwhile, would get the biggest presence in one of America’s most lucrative markets out of the deal.

So, yes, there are plenty of merger possibilities, but it is unclear if the next one will be expected (Frontier-Spirit) or something that few saw coming (like Alaska’s acquisition of Virgin America).

Steele Luxury Travel

www.SteeleTravel.com